Practices of Board Diversity

The Board of Directors’ diversification

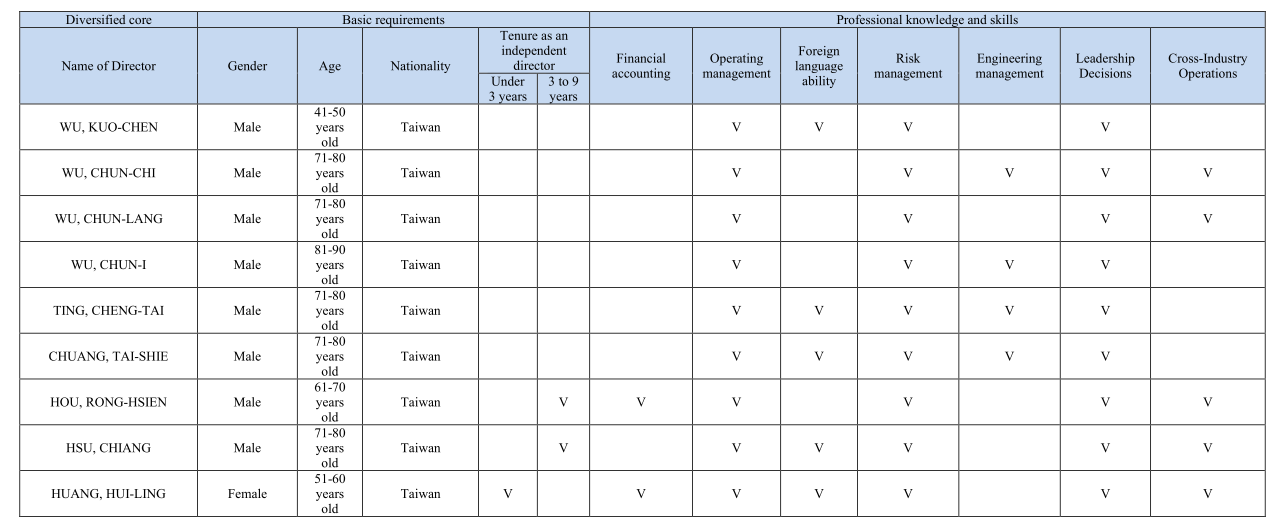

According to Paragraph 3, Article 23 of the Company's Corporate Governance Best Practice

Principles, all members of the board shall have the knowledge, skills, and experience necessary

to perform their duties. To achieve the ideal goal of corporate governance, the board of directors

shall possess the following abilities:

2. Ability to perform accounting and financial analysis.

4. Ability to conduct crisis management.

6. An international market perspective.

8. Ability to make policy decisions.

Governance Best Practice Principles on March 24, 2020 to formulate an appropriate

policy on diversity based on the company's business operations, operating dynamics,

and development needs, i.e., basic requirements and values (such as gender, nationality,

and tenure as an independent director), professional knowledge and skills (accounting

and finance, operation management, foreign language, risk management, engineering

management, leadership decision, and cross- industry management).

The Company has nine directors (including three independent directors, proportion for

director has reached 33.3%, and proportion for 1 female director has reached 11.11% ),

one of whom are certified public accountants, two of whom has a professional background

in business management, and the other directors have many years of experience in the

industry, so they are able to carry out the duties and responsibilities of the Board of

Directors and protect the interests of shareholders.

director has reached 33.3%, and proportion for 1 female director has reached 11.11% ),

one of whom are certified public accountants, two of whom has a professional background

in business management, and the other directors ave many years of experience in the industry,

so they are able to carry out the duties and responsibilities of the Board of Directors and

protect the interests of shareholders.

The Company values the competency of the board members. Two or more directors shall

possess one of the expertise to be diversified. Two or more directors possess one of the

expertise so far, therefore the compliance rate is 100%. The tenure of the independent

director may not exceed nine years. All three independent directors’tenure is under

nine years, so the compliance rate is 100%. The implementation status is as follow:

Notice: All related information and statistics on Investor our website page are only for references, not for investment recommendations.

TYC and sources of information shall not be responsible for any inconsistencies and delays of the content, and other activities related to investment.